Announcement: In preparation for the implementation of OMB’s October 1, 2024, revision (“2024 Revisions”) to the OMB Guidance for Federal Financial Assistance; Final Rule – Title 2 of the CFR, the Department of Contracts and Grants and The Office of Financial Analysis have collaborated to provide a summary of some significant revisions and how they will be implemented so that our research community will be aware and respond.

The Final Rule introduces several revisions, including increases to thresholds for equipment/supplies, modified total direct costs (MTDC), de minimis, fixed amount awards, and single audit. The federal agencies are responsible for implementing the guidance by October 1, 2024. As of September 20, not all agencies have announced their implementation plans (see the Status of Agency Implementation Matrix below which will be updated as new information becomes available). It is uncertain what it will mean if an agency does not comply with the October 1st deadline.

The analysis and guidance provided are based on our current understanding of OMB’s implementation. However, uncertainty remains regarding how certain agencies will implement the guidance. Therefore, these recommendations should be considered with this in mind. We recognize that there are still unresolved issues, and we will continue to review and update this guide as necessary. Should significant changes occur, we will notify the community accordingly.

Significant Changes Implemented in the Updated Uniform Guidance:

- Vacation Balances at Termination– Effective 10/01/2024, vacation balances at termination cannot be charged to a grant for payment.

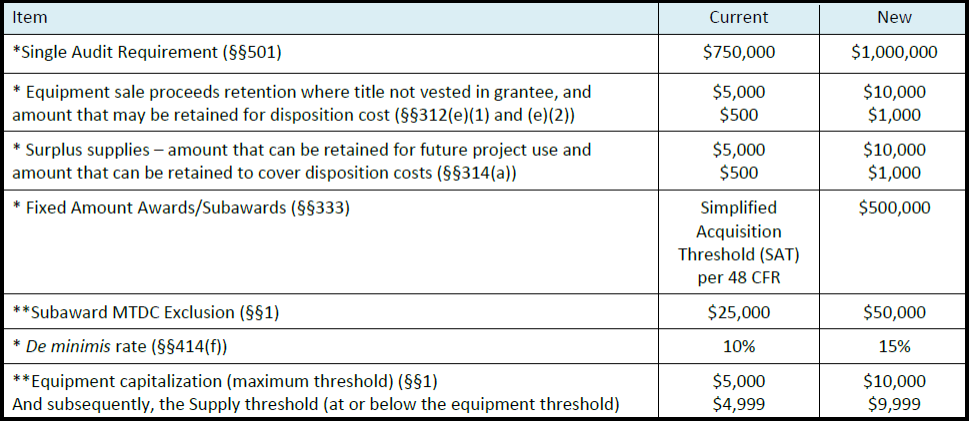

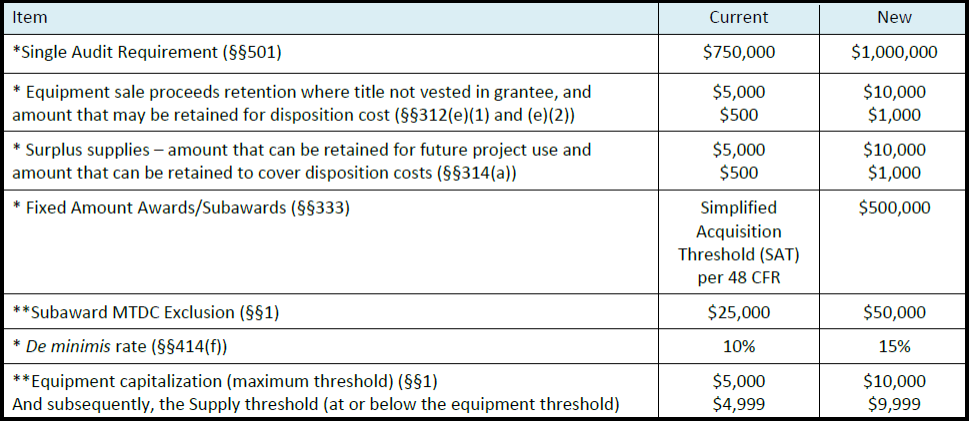

- Changes in Limits and Thresholds: The updated Uniform Guidance changes the dollar thresholds in a number of areas. However, keep in mind that no threshold changes will be implemented, effective 10/1, as those that conflict with USC’s current rate agreementwill not go into effect until a revised rate agreement is in place.

Below is a table detailing the threshold changes under the new Uniform Guidance.

*Implement on awards issued or revised on October 1, 2024, and beyond.

**Implement with your negotiated F&A cost rate, rate extension, or rate modification and subsequent receipt of new award or competitive renewal. USC’s current rate agreement does not expire until 6/30/2026. At this time, please continue to use the Subaward threshold of $25K and the equipment cap of $5K for all USC budgets. USC currently has in effect a rate agreement that is valid until the end of FY26 (June 30, 2026)

Note: Equipment Capitalization Threshold – While the limit has increased to $10,000, the decision to change the threshold is under revision. Should USC decide to change their threshold up to the new amount, it will be implemented as part of USC’s next negotiated agreement, which would take effect in FY27 and later. Should there be a delay in the negotiation of rates by June 30, 2026, further instruction will be provided on how to proceed.

Changes for Outgoing Subawards:

- SAM Registrations: This clarification states that a UEI is needed for subrecipients receiving federal assistance awards, but full SAM registration is not needed to receive a UEI. However, full registration is needed to receive federal contracts. Also, substantial revisions have been made to the conditions under which a federal agency may grant an exception to SAM registration requirements.

- Fixed Price Subawards: Fixed Price Subawards are still restricted without sponsor prior approval. The updated Uniform Guidance has added back the requirement that Fixed Price Subawards cannot be used if there is cost share and has included a requirement that at the end of the fixed amount award, certification must be provided, in writing, that the project was completed “or the level of effort was expended”…as agreed to in Federal Award. If the project was not completed, the activities not completed must be identified as well as all incurring expenditures being in accordance with §200.403.

- Higher Risk Subawards: USC currently conducts a risk assessment and notifies the PI and school of higher risk Subawards. Under the new Uniform Guidance, USC will be required to notify the sponsor of higher risk Subawards and provide information about the specific conditions that will be added to address risk concerns.

- De Minimis Rate: The updated Uniform Guidance has increased the indirect cost de minimis Because of this, pass-through entities can approve an indirect cost rate of up to 15% (previously 10%) for subrecipient organizations that do not have a federally negotiated indirect cost rate, allowing subrecipients (such as nonprofits and small businesses) to increase their cost recovery.

- Subaward Certifications: The 2024 revision adds that all tiers of subrecipients must now certify the accuracy of their proposals, invoices, and financial reports: “I certify to the best of my knowledge and belief that the information provided herein is true, complete, and accurate. I am aware that the provision of false, fictitious, or fraudulent information, or the omission of any material fact, may subject me to criminal, civil, or administrative consequences including, but not limited to violations of U.S. Code Title 18, Sections 2, 1001, 1343 and Title 31, Sections 3729-3730 and 3801-3812.” USC has updated our Subaward Certification Formto include this statement. If a Letter of Intent is used instead, this statement will need to be included.

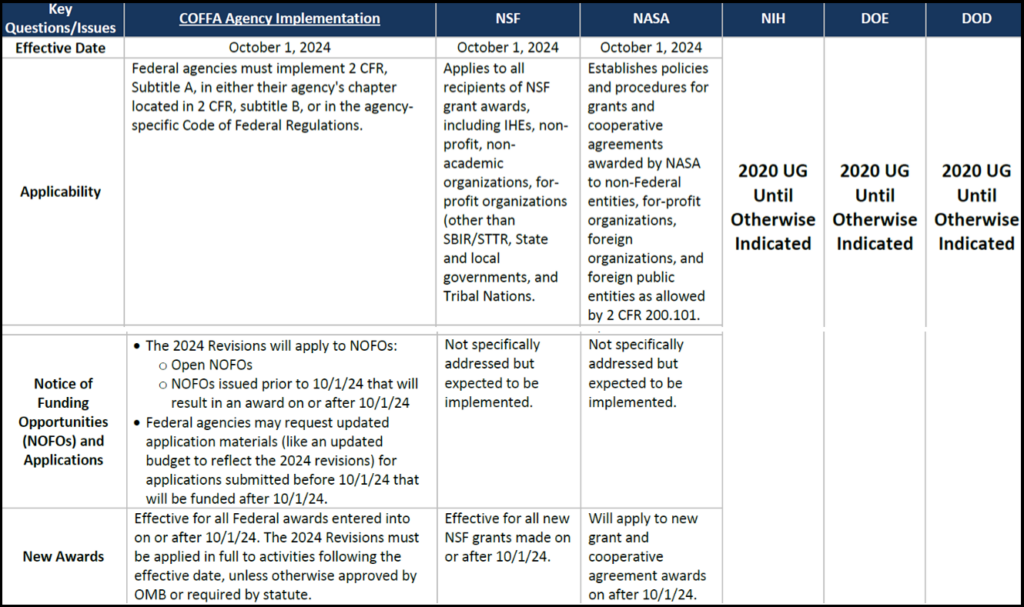

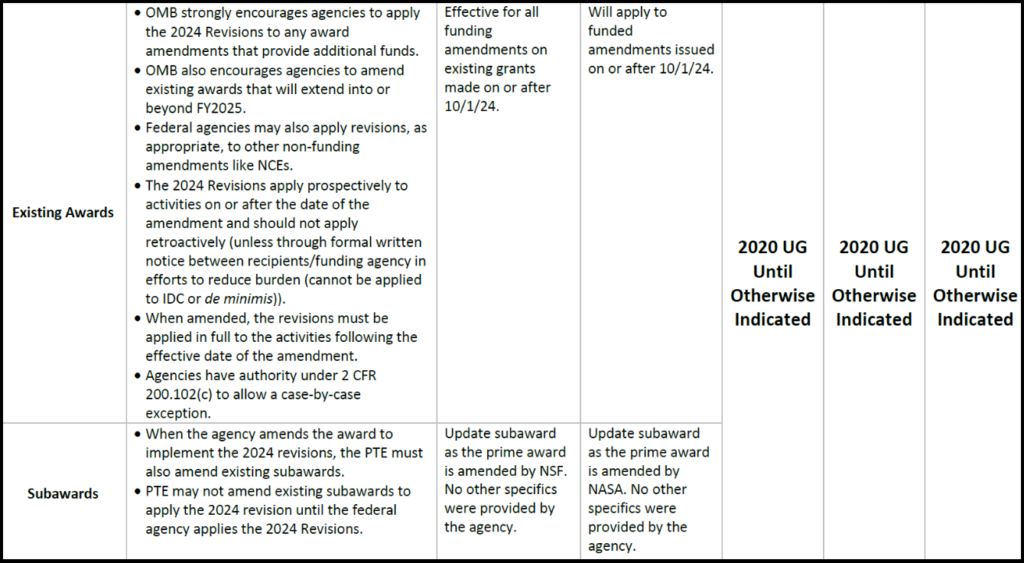

How Federal Agencies Are Implementing the Changes:

At this time, we are awaiting agency-specific implementation guidance from several agencies. The National Science Foundation has formally issued guidance implementing 2 CFR in the Grant General Conditions (GC-1). In this action, NSF archived the Research Terms and Conditions (RTC) and the NSF Agency Specific Requirements. For more information, see our Newsflash on this NSF update. Additionally, NASA has also issued its implementation through a Federal Register Notice and Grant Notice 24-01. For more information, see our Newsflash on this NASA update. We will continue to provide updates as we receive guidance from other agencies.

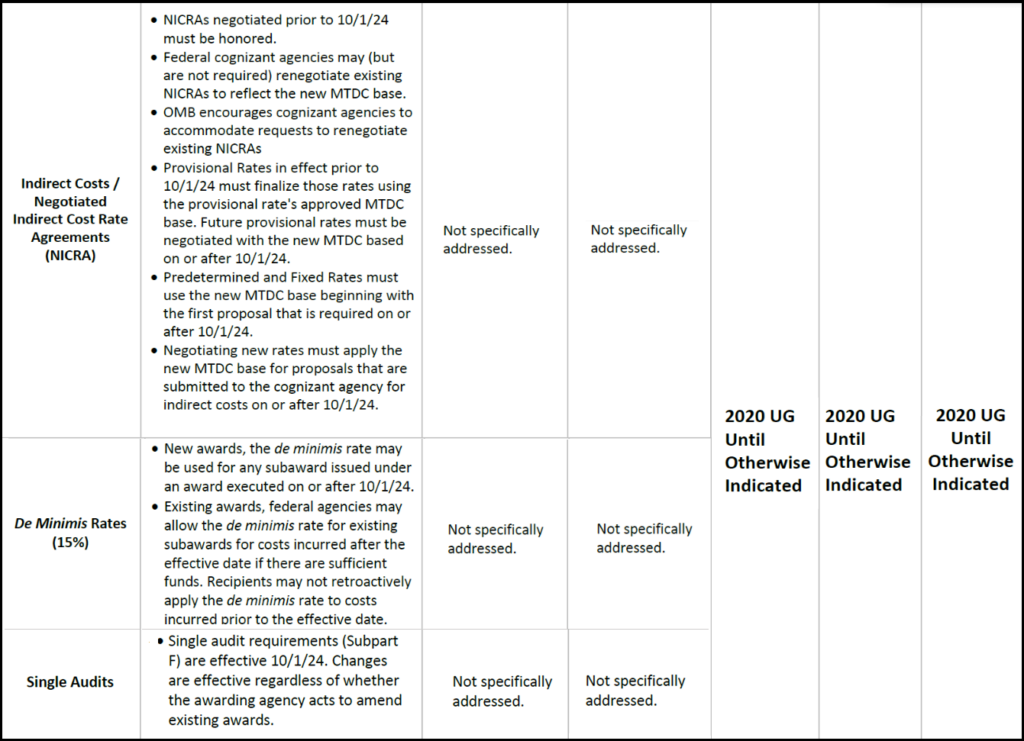

Below is a helpful table laying out what we currently know about different agency implementations:

References:

- Office of Management and Budget Implementation Guidance (Click Here)

- Redline Document Showing 2024 Changes (Click here)

- COFFA Uniform Guidance (Click Here)

Questions? Please direct any questions to the DCG Contracts and Grants Officer assigned to your unit.